在外汇市场交易

购买和出售主要、次要或外来货币对

交易有风险

贸易来源

0.0 点差

贸易来源

$0 佣金

直到

1: 无限杠杆

+

70 货币对

贸易来源

0.0 点差

贸易来源

$0 佣金

直到

1: 无限杠杆

+

70 货币对

在外汇市场交易 70 多种货币对

做多或做空主要货币、次要货币和稀有货币

符号

出价

问

点差

*本页价格仅供参考。流动性较低的工具,如但不限于外来货币对、股票和指数,其价格不像一般交易工具那样经常更新。请查看您的MT4/MT5平台内的最新实时价格

什么是外汇市场?

外汇市场是全球各国货币兑换的市场。它是全球最大、流动性最强的市场,日均交易量达 7.5 万亿美元。

外汇市场每周 5 天、每天 24 小时开放,分为 3 个主要交易时段。为全球交易者提供无与伦比的机会和渠道。

外汇交易主要通过分散的电子银行网络进行,在全球经济中发挥着至关重要的作用。它是促进国际贸易和投资的重要媒介。

外汇交易如何运作

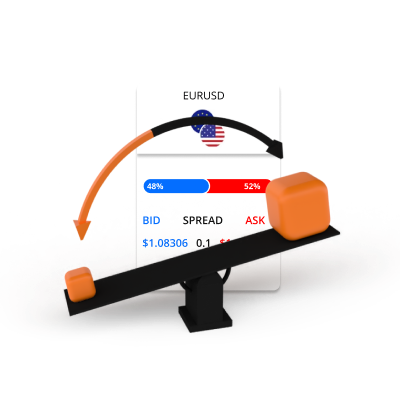

外汇交易涉及同时买入一种货币并卖出另一种货币。例如,如果您认为由于欧盟经济强劲增长,欧元兑美元汇率将上涨,您可以选择买入欧元/美元货币对。

买入价和卖出价

做多或做空

外汇以手数进行交易

外汇交易涉及杠杆和保证金

外汇交易示例

您决定以 1.0800 的价格购买 0.1 手 EURUSD,杠杆为 200:1。交易涉及的两种货币是欧元和美元。

EUR 10,000

EUR 1 = USD 1.0800

EUR 10,000 x 1.0800 = USD 10,80

USD 10,800 / 200 = USD 54

现在,您已同时卖出 10,800 美元,从而在 EURUSD 中建立了 10,000 欧元的多头仓位。由于外汇交易使用杠杆,因此您交易账户中的保证金仅为 54 美元。一段时间后,EURUSD 之间的汇率发生变化,您决定卖出。

场景 1

汇率从欧元/美元 1.0800 上涨至 1.0850。

这就是交易利润或亏损的计算方法。

盈亏=((当前汇率-初始汇率)

x 头寸价值)/ 当前汇率

损益 = ((1.0850 - 1.0800) x 10000) / 1.0850

损益 = (0.0050 x 10,000) / 1.0850

损益 = 46.08 USD

场景 2

汇率从欧元/美元 1.0800 下跌至 1.0750。

这就是交易利润或亏损的计算方法。

盈亏=((当前汇率-初始汇率)

x 头寸价值)/ 当前汇率

损益 = ((1.0750 - 1.0800) x 10,000) / 1.0750

损益 = (0.0050 x 10,000) / 1.0750

损益= -46.51 USD

极具价值的交易与优质服务

这就是像您这样的人选择TIOmarkets的原因

点差低至0.0 pips

直接由我们的流动性提供商提供raw可变点差交易

零佣金

在我们的VIP Black或Standard交易账户上,从$0每手开始交易

低起点金额

只需$20即可开户开始交易

快速订单执行

交易在毫秒内执行,大部分时间滑点低

不限leverage。

通过使用不限leverage进行交易,发挥最大潜力

30%忠诚奖励

在我们的Standard账户每次存款均可获得奖金

在 MT4 或 MT5 交易平台上交易

通过您的桌面电脑、网络浏览器或移动设备

入门简单快捷

只需几分钟,操作方法如下

步骤 1

注册

完善您的个人资料并创建账户

步骤 2

基金

通过我们方便的存款方式立即存款

步骤 3

贸易

下载交易平台并登录开始交易

交易有风险